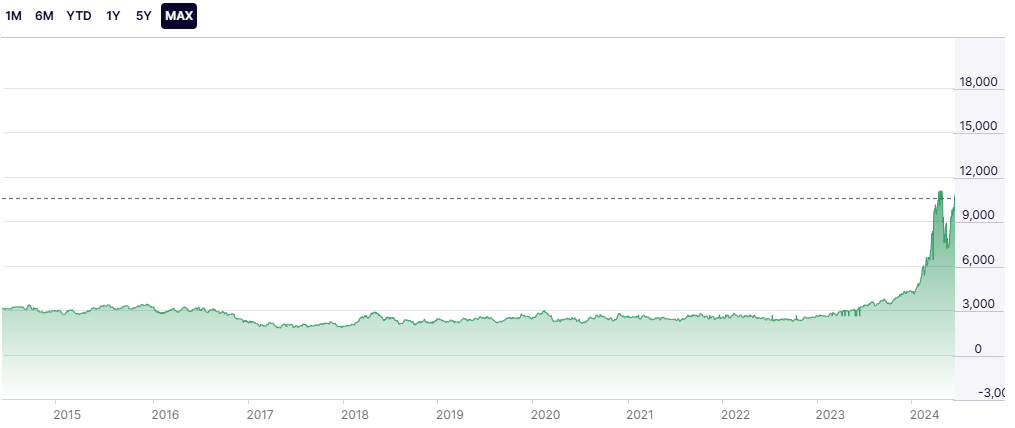

In recent months, the global market has witnessed a significant surge in raw cocoa prices, prompting concern among chocolate manufacturers, retailers, and consumers alike. This unprecedented increase is driven by a confluence of factors, including climatic challenges, supply chain disruptions, and heightened demand, creating a ripple effect across the chocolate industry. As you can see below, the price per ton of raw cocoa has tripled in the last year:

Climatic Challenges Impacting Cocoa Production

One of the primary drivers of the cocoa price surge is adverse weather conditions in key cocoa-producing regions. West Africa, particularly Côte d’Ivoire and Ghana, which collectively account for over 60% of global cocoa production, has experienced erratic weather patterns. Unseasonal rains and prolonged dry spells have severely affected cocoa yields, leading to reduced harvests. These climatic challenges are not only impacting the current supply but also threatening future harvests, adding a layer of uncertainty to the market.

Supply Chain Disruptions

The global supply chain has been under immense pressure, exacerbated by the COVID-19 pandemic. Transportation bottlenecks, increased shipping costs, and port congestion have created significant delays in the delivery of cocoa beans to international markets. Additionally, labor shortages in key producing regions, due to pandemic-related restrictions and health concerns, have further strained the supply chain. These disruptions have contributed to the rising costs of transporting and processing cocoa, ultimately inflating the prices.

Rising Demand and Market Speculation

Despite supply challenges, the demand for chocolate and cocoa products remains robust. As economies recover and consumer spending increases, the demand for confectionery and premium chocolate products has surged. This heightened demand, coupled with supply constraints, has created a tight market, driving prices upwards. Furthermore, market speculation and trading activities have amplified price volatility, with traders anticipating further supply shortages and adjusting their strategies accordingly. Currently, over 60% of the total cocoa futures and options are now held by non-commercial investors, which is a historic high.

Economic Implications for the Chocolate Industry

The increase in raw cocoa prices is having a profound impact on the chocolate industry. Manufacturers are grappling with higher production costs, which inevitably translate into increased prices for consumers. Smaller artisanal chocolate producers, who often operate with thinner profit margins, are particularly vulnerable to these cost fluctuations. Some manufacturers are exploring cost-saving measures, such as reformulating products or sourcing alternative ingredients, to mitigate the impact. However, maintaining the quality and taste that consumers expect remains a top priority.

Sustainability and Ethical Considerations

The surge in cocoa prices also underscores the importance of sustainable and ethical sourcing practices. Many cocoa producers are smallholder farmers who face economic hardships, and the price increase could potentially improve their livelihoods. However, it also highlights the need for fair trade practices and investment in sustainable farming techniques to ensure the long-term viability of cocoa production. Companies committed to ethical sourcing may face higher costs in the short term but are likely to benefit from a more resilient supply chain in the long run.

Looking Ahead: Future Prospects and Strategies

As the cocoa market navigates these turbulent times, industry stakeholders are closely monitoring weather patterns, supply chain developments, and consumer trends. Investments in technology and infrastructure to improve supply chain efficiency and resilience are becoming increasingly critical. Additionally, fostering partnerships with cocoa farmers to support sustainable practices and improve crop yields can help stabilize the market.

In conclusion, the recent surge in raw cocoa prices is a multifaceted issue with far-reaching implications for the chocolate industry. While it presents challenges, it also offers an opportunity to address systemic issues within the supply chain and promote more sustainable and equitable practices. As the industry adapts to these changes, consumers may see higher prices, but they can also take solace in the efforts to ensure that their favorite chocolate treats are sourced responsibly and sustainably.